When it comes to many loans, your credit score will determine what you pay. This is true of student loans, car loans, and mortgages. So when you’re buying a home, the higher your credit score, the lower your mortgage rate will be.

What’s Considered a Good Credit Score?

Your credit score is determined by the following factors:

- Payment history

- Current levels of debt

- Length of credit history

- New Credit

- Types of credit used

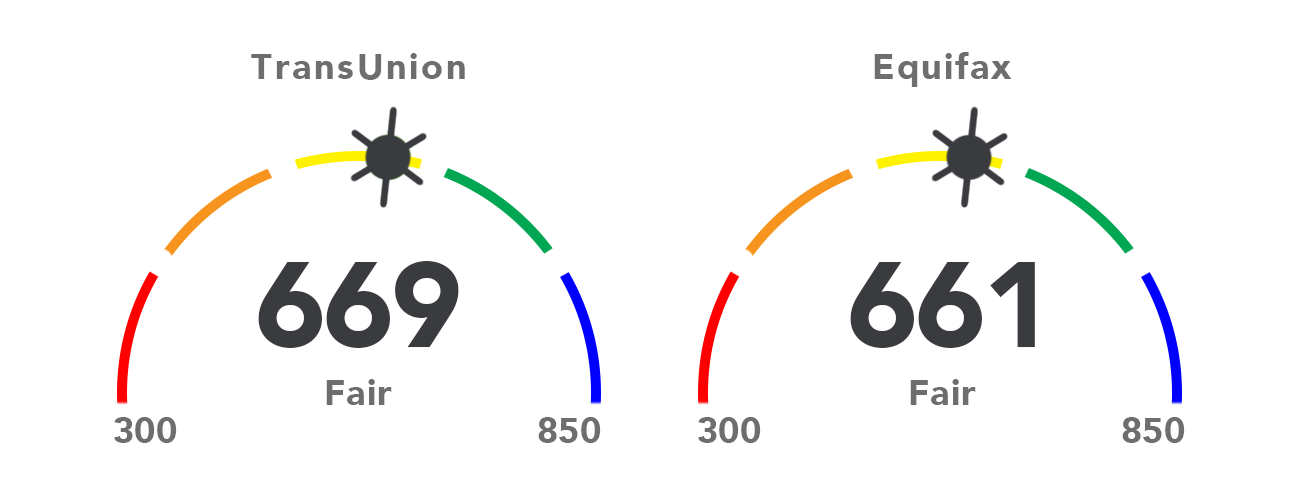

Most credit scales range from 300 to 850. 670-700 is typically considered a good score. Many lenders use credit scores to make their lending decisions, but each lender has a different threshold of risk they find acceptable for a given credit product.

What Can Cause a Credit Score to Drop

The more you know about what can hurt your score, the better prepared you are to raise your score. Here are some important factors that can help drop your score:

- On-time payments are critical. Just one late payment can reduce your credit score by 50 points or more.

- The quicker you can make a payment, the less severe the reduction of your score.

- Multiple late payments make your credit score even worse. One missed payment could be accidental while four could be very damaging to your credit.

It’s recommended that if your score is lower than 670, you need to do some work on your credit rating– especially if you’re planning to buy a home. Improving your credit score means improving your chances to receive the best mortgage rate.

5 Steps to Improve Your Credit Score

Following these steps will help you improve your credit for the best mortgage rates.

1. Know Your Credit Report

You can request a credit report once every 12 months from the top three credit bureaus– Equifax, Experian, and TransUnion. In the meantime, you can keep up with your credit score by using services like Credit Karma which allows you to check your score for free.

2. Dispute Any Errors

If you spot any mistakes on one of your three credit reports, you need to take action right away. Contact the credit reporting company with a letter to detail the inaccuracies. The Federal Trade Commission recommends using their consumer dispute letter to address your credit report issues.

3. Pay Down Credit Balances

Always pay your minimum statement on time each month, and pay more than the minimum when you can. However, the best strategy for raising your credit score is to pay your credit cards off in full on a monthly basis. This is especially important if you have high-interest cards– you don’t want to get stuck being captive to high-interest rates because it will only make it harder to work on your credit score.

4. Set Up Payment Reminders to Always Pay On Time

Paying on time is the most important thing you can do to maintain your credit score. Set up reminders so you never miss a payment and sabotage your score.

5. Boost Your Credit Utilization

Credit utilization is your balance-to-limit ratio and it measures how much money you owe creditors versus how much credit is available to you. So if you have a balance of $1,000 on your credit cards but have a $10,000 credit limit, your credit utilization would be 10%. Similarly, there’s a term in finance called debt utilization, which is your total debt divided by your monthly income. For the best mortgage rates, you should keep your debt utilization ratio under 30%.

The best way to improve your credit utilization (and reduce your debt utilization) is to pay off your debts.

While debt utilization doesn’t affect your credit score, it’s something that lenders look at when considering whether to lend to you. The key to a lower mortgage rate is a low debt-to-income ratio.

Conclusion

A good credit score is important, but good credit history is even better when it comes to applying for mortgage loans. So work for good credit and then build a history of it. If you’re ready to find out about home loan rates or have questions about a current home loan, contact CIS Home Loans.